Arion Bank's Digital Future Accelerator

Designing the Digital Journey of a Bank

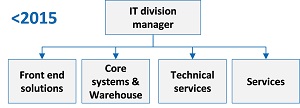

Changing a corporate’s approach on innovation is a huge undertaking. In the midst of international awareness of technological discussion and expected changes in the financial industry, Arion Bank’s own efforts to support the local startup ecosystem and internal corporate structural changes, the Bank managed to radically change its digital product development and delivery. The formation of Arion Bank’s accelerator, commonly referred to as Digital Future, was a major milestone in better serving its customers and their expectations of more convenient banking.

Prior to 2016, Arion Bank’s IT workflow was somewhat traditional. The project selection process took time and the project outcome did not necessarily meet business demands. To some extent, IT and business were not speaking the same language, at least not fully understanding each other. In such a scenario, blame-gaming can easily accelerate. The business side felt that IT did not understand how to fulfill the needs of the customers while IT felt that the business side did not understand the technical side of the business. In many circumstances, the culture may have made the IT department feel isolated. Plainly put, IT was IT and the business side of the Bank was just that, the business side. The two divisions were in many instances not part of the same company metaphorically. This translates into the Bank being unable to capture the business value intended with its IT projects.

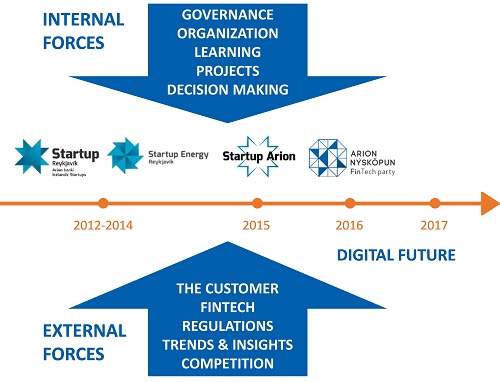

Arion Bank's IT organization prior to 2015

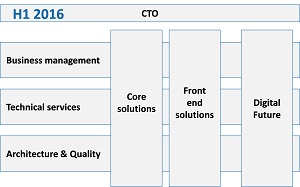

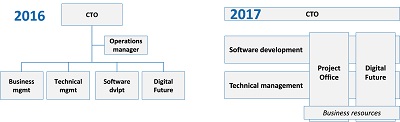

A new CTO was hired internally in early 2016 who had a managerial background from Marketing and Business Development as well as from IT. Other changes in top management of the Bank resulted in the fact that the CTO became part of the Executive Committee. IT had previously been under the COO. With a CTO at the executive table, the digital journey was lifted on the Bank‘s agenda.

The IT organization was changed substantially. One of the largest changes took place in 2016 when IT operations were outsourced completely to a third party, reducing the IT team by 20%. The change provided scope for more focus on business and software development through Digital Future and Project Office. In Arion Bank‘s experience, the success of the initiation of Digital Future can be assigned to a strong will of top management to implement a disruptive process and organizational changes. In other words, favourable human interaction in conjunction with structural changes and a strong commitment to the digital journey that trickled down the organization to all levels. Arion Bank committed itself from the outset to funding the entire project for at least five years, a large undertaking in every aspect for a company of its size.

The advisors brought in a relatively standardized and well-known two-speed IT project approach. The thinking behind a two-speed IT is that it helps companies develop their customer-facing capabilities at high speed while decoupling legacy systems for which release cycles of new functionality stay at a slower pace. Arion Bank has since made adaptations to this approach to align it to the Bank‘s organization, capabilities and strategy. For instance, the Bank has added a professional development dimension into the project approach to ensure that employees lent to the projects are all trained in the same way of working.

The Outcome

Changing the structure and workflow proved to be highly successful. Arion Bank’s Digital Future Accelerator has delivered fourteen projects in the first seventeen months and many more are in the pipeline. What would have taken years to deliver in the older structure only took one year. See White Papers on some of the first projects in the Further reading section below. The pictures below depict some changes in customers’ behavior and impact of the delivered solutions. Customer behavior in need of a credit assessment and mortgage post digital self service offering.

Scale intentionally not shown

- Digital service initiated Dec´16

Key Learnings

The transformation of digital product development and delivery was successful for Arion Bank. The key learnings for Arion Bank were amongst others:

Predefined workflow saves time

The composition of each project team has specific roles and the workflow is always the same. Hence, it streamlines the project organization saving huge amounts of time. It helps the team focus on the “what” rather than the “how”. Any project manager understands the dilemma. Over time, the core team gains better skills and understanding of the fundamental methodology and can apply solutions to particular problems systematically.

Continuous feedback creates wanted culture and ethic

Managing a new team every 16 weeks is a challenge for the Accelerator’s middle management team. It is compensated by regular feedback to every team member during the project’s lifetime. The feedback loop is clearly defined from the outset and ensures coordinated methods and procedures both within each team and between teams that run projects in parallel.

Lawyer from legal department describing her participation in Digital Future.

Higher speed

The methodology works in practice, particularly in terms of how rapidly the Bank can deliver new and improved products and better user experience to its customers. These facts resulted in the adoption of the methodology in all software development projects of Arion Bank.

New knowledge and workload transfer

Despite definite results in development and product releases, it is a challenge informing and educating customers and employees on the innovations. Guiding customers through a new flow in service is a challenge. Employees need knowledge of these products and processes to be able to answer customers’ questions. Additionally, the new processes shift the workload within the Bank, e.g. less load on branch employees, shifting it to the Call Center or Back Office. New internal processes may even arise to complement the new digital offering. Managing the Bank’s organization as a whole is an everlasting challenge, both in terms of adaptation capability and employee know-how. The speed of product releases requires the organization to be adept and alert.

Managing expectations is material

Investing in change is a risk. In Arion Bank’s case the risk-taking has already paid off as the result in numbers show. Subsequently, it is important to maintain a high positive profile on the Digital Future Accelerator internally within the Bank to secure and preserve the commitment to the digital transformation. This commitment is a key factor in the Accelerator’s success. Yet, delivering a product that “only” solves 80-90% of the problem calls for possible internal friction, e.g. if manual labor was created somewhere else in the organization. Still, in a given time period, it is better to have delivered ten products that solve 80% of the problems than two products that solve 99% of them. Managing these expectations remains a challenge.

APIs will be a deciding factor

A key component in the success of Arion Bank’s Digital Future Accelerator has been the use of internal and external APIs. Communicating with e.g. tax authorities in order to collect tax returns and obtaining credit ratings from credit scoring companies help the Bank to get a holistic view of a customer’s financial health and add value to the services Arion Bank offers its customers. The importance of data has never been greater. The companies that responsibly and respectfully use data or services through APIs to serve their customers will be in a winning position. Business models of financial institutions are currently challenged. APIs will play a bigger role in the development of not only new services but new business models. All in all, Arion Bank’s Digital Future is here to stay and has had a wider impact on the Bank’s IT organization and structure than originally anticipated.

Examples of delivered digital solutions

- Customer onboarding

- Corporate customer onboarding

- Open new accounts

- New credit cards Credit card payment split

- Credit assessment for mortgages

- Mobile cash transfers

- Mortgage lending Online trading

- Pension fund services

- Start / change personal overdraft

- Change credit card limit

- Freeze / reopen credit card

All solutions are fully automated end-to-end customer journeys where the customer can self service themselves anywhere in the world and anytime during the day.

About Iceland

Situated in the North Atlantic Ocean between Europe and the United States, Iceland is a European country with 330,000 inhabitants. The capital and largest city is Reykjavik. Two thirds of the country's population live in the Greater Reykjavik area. Iceland, as other Nordic countries, ranks high in economic, political and social stability and equality.

Icelandic citizens are early adopters when it comes to technology and technical infrastructure is good where 97% of residentials have access to internet. Iceland ranked number six globally in terms of GDP per capita in 2016 according to the International Monetary Fund.

About Iceland on iceland.is

Appendix

The Guiding Principles of Arion Bank's Digital Future

1) End-to-end customer journey

Each project taken on in Arion Bank’s Digital Future accelerator addresses and tackles a key end-to-end customer journey where the ambition is to achieve on average a 10X improvement through each project rather than a marginal 10-20% improvement of the process. As a given premise, the only way to achieve such a large improvement is through a zero-based redesign of the complete customer journey. A good example of such a project is a customer’s credit rating journey, a prerequisite for mortgages for retail bank clients. The previous process took on average 10 days where the customers themselves had to gather various documents (e.g. last year’s tax return, salary slips, outstanding loans) and submit them to the bank. The bank then performed extensive manual work in entering this information into different systems to reach the client’s credit score. The new automated process at Arion Bank takes three minutes where the customer only needs to enter the email address and phone number associated with their electronic ID. Based on this information, Arion Bank automatically collects all the relevant information through APIs from external partners with the customer’s consent.

2) Team and co-operation

For the duration of each project, the team is 100% focused on that single project. Team members hand over their normal day-to-day tasks to colleagues with out-of-office messages on their email and phones. They are solely members of the Digital Future project. The team is composed of a business cell and an IT cell, each comprising 6-8 employees. A project manager, scrum master and a change agent lead the IT team. They are co-located 5 days a week in a team room shielded off as necessary for increased productivity. The business cell is composed of front and back office personnel, designers and specialists such as from the Bank‘s risk management, marketing and legal divisions. The business cell participates fully for the entire duration of the project, not just during the analysis and design phases. The IT cell has full-stack capabilities and is self-sufficient throughout the project. The composition of the team varies and depends on the nature of the customer journey being worked on. The team members are hand-picked and candidates are generally: visionary, demonstrate out-of-the box thinking, are positive and ambitious, pragmatic and solution oriented, have strong problem-solving skills and are not afraid to get their hands dirty. The participant selection is evidently also based on core expertise. This new approach to working need not suit everyone - high velocity, unconventional organization, hard deadlines and some uncertainty are part of the deal. Some employees handle these challenges better than others. But the right candidates flourish in the environment. When the temporary members return to their daily jobs, they bring the experience with them. Over time, more and more employees of the Bank will learn the new principles and share them with their colleagues, making the whole organization more flexible.

3) Startup mentality and Customer approach

In essence, Digital Future projects function like a startup company within an established organization. Each project is fully financed with venture capital and resources. The team is trusted to make the most of the investment. As within a startup company, each project is considered a business driven entity with an IT component rather than a pure IT project. The selection process is in the hands of the Bank’s executive board which prioritizes the E2E customer journeys that are handed to Digital Future based on the expected value to the customer, the Bank and its employees – in that order. At initiation, the single known or given thing is which particular customer journey is being redesigned. All further detailing awaits the first workshop in which the whole team and key stakeholders participate. The first day in Digital Future is about mapping the current process. On the second day, the team creates a vision of a friction free and intuitive customer journey. Based on that work, the team determines the Minimal Viable Product of the project, keeping in mind that a bank serves various and different customer segments. Thus, the customer is constantly at the forefront and team members are aware and reminded that the solutions created need to be actively used by the customers. Already on the third day, the team starts testing mock-ups of the new process with real life customers. Designers are vital in making the new process come to life in order to effectively communicate and test it with customers. The customer journey is then iterated throughout the project lifetime with customer testing conducted almost every week until final delivery. In the startup world, this process is commonly referred to as the Lean Startup methodology.

4) Time frame of 16 weeks

Each Digital Future project is limited to 16 weeks. A fixed time-period and fixed budget means that the scope of the project varies between projects. Besides focusing the team and forcing it to prioritize, the fixed time frame also serves as a risk management technique – if a project doesn’t create the anticipated value, the losses are cut at the end of week 16.The team is empowered to make all but the most critical decisions themselves with the ambition that the team never needs to wait for anyone. Quick decision making is ensured with at least a weekly decision meeting with 3-4 C-suite executives, whose responsibility is to remove obstacles and ensure that the team can maintain speed throughout the project.

5) No roadblocks

A tight timeframe demands discipline and a rigid structure. Experience has shown that all projects meet hurdles and obstacles on the way. Managing these roadblocks is the responsibility of the Head of Digital Future. Managing and keeping up the development and production pace without disruption is challenging and time consuming. The team is encouraged to be solution oriented, to strongly believe in its capability nothing or no one can impede the team in achieving its goals. In a larger organization like a bank, such mentality cannot be taken for granted. It is a matter of training. In Arion Bank’s experience, the mentality of no-roadblocks is infectious; where the Digital Future team has demonstrated admirable problem-solving skills with tough deadlines on behalf of its external partners, e.g. Iceland Tax Authorities and key IT vendors.

6) Commitment throughout the organization

As stated above, the Bank as whole with the Executive Committee in the lead is highly committed to the Digital Future process. The CEO and three Managing Directors take part in weekly decision meetings only concerned with Digital Future. The financial commitment is secured, since the Digital Future projects are fully financed for the next 4-5 years in the Bank’s business plan. The Board of Directors regularly requests and discusses updates and strategy surrounding Digital Future. Top and middle management also see the benefit, since they compete for their projects being accepted into the next cycle and therefore show full commitment in supplying the full-time employees which Digital Future demands.