Branch Network Strategy in a Digital World

Bank branches may seem outdated in today‘s world where everything is interconnected. Yet, they serve an important purpose for banks. They are the face of the bank to the customer, the place where service is provided and they remind customers and others that a bank is not only a digital bank but has a physical presence, which in psychological terms portrays trust. Arion Bank has adopted a new branch strategy that, in combination with its investment in digital services, aims at providing even better services to its customers.

The history of the bank branch is similar throughout the Western world. The number of branches is declining. Increased digital service provision and focus on lower costs are the primary reasons. At the same time, customers are provided with better service since the majority of customers‘ daily banking needs are now available to them at any hour of the day, not only during typical banking hours.

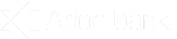

Number of bank branches in the Nordic countries

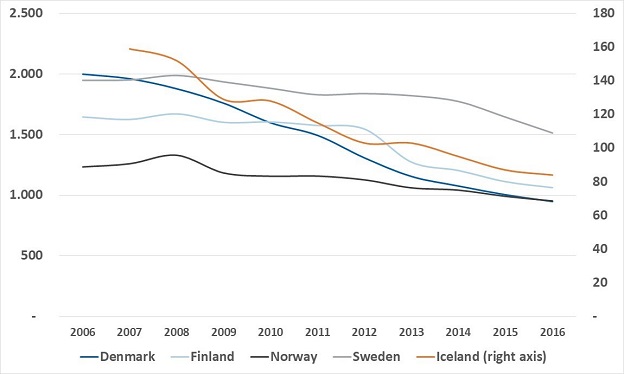

Number of bank branches pr. 1,000 inhabitants

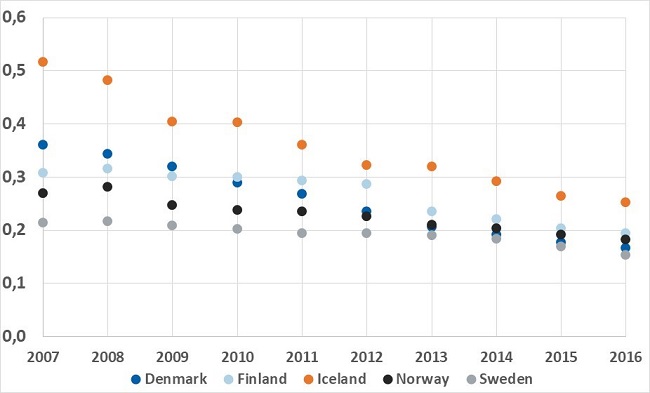

The pattern is the same in all of the Nordic countries, although geographical differences explain the diversity in numbers. The Nordic countries have been leading in the use of digital payments (debit and credit cards) which is reflected in less use of cash in all the Nordic countries. Iceland is no exception.

Cash circulation as % of GDP in selected countries in 2015

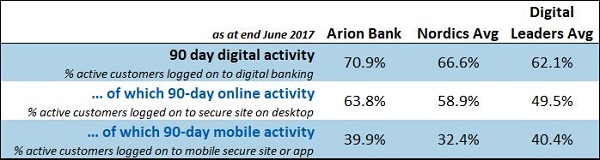

In parallel, Nordic banks have been quick jumping on the digital wagon not only in terms of payments, but in digital banking services in general. Nordic retail and corporate customers have been used to online banking and mobile banking for several years now and the pace of new services has picked up fast in the past 3-5 years. This fact is presented in a wide research performed by FinAlta. Nordic customers are more active digital banking users than in most countries. Arion Bank’s customer base is even more active than the Nordic average bank.

The pattern is upwards around the globe. Customers are highly receptive to enhanced digital banking services. Yet, they still seem to prefer to use all channels available to them. The bank branch is far from being outdated or obsolete.

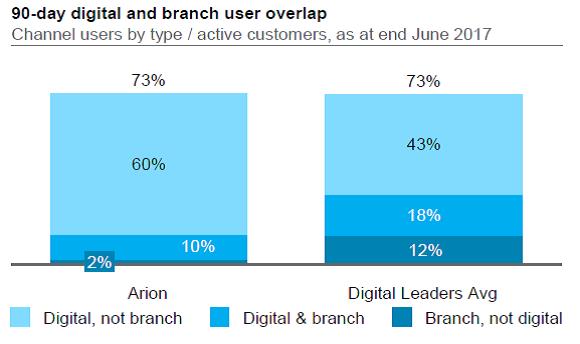

As seen in the table and picture above, Arion Bank’s customers are digitally more active than customers of Digital Leaders in the world according to FinAlta definitions. Although Arion is proud of this fact, it does not tell the whole story. Arion’s product or feature availability in online/mobile offering is somewhat less diverse compared to the Digital Leaders’ii. At the same time, it shows how much Arion customers use the available digital offering. For Arion, there is still room for improvement, i.e. in guiding customers further into using the digital services. One example would be to reduce the use of branches for simple transactions such as money transfers and payments, see picture below.

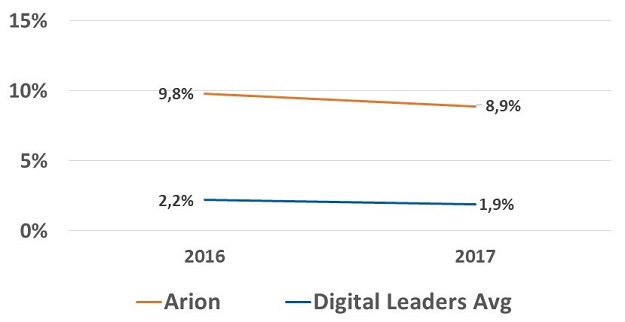

% of money transfers and payments made in branch. Source: FinAlta

Arion has invested heavily in digital banking and financial solutions in recent years which has made a huge impact on how customers behave in regards to digital banking. See other White Papers in the Further reading section below. Easy and intuitive solutions designed in an end-to-end process have improved customers’ satisfaction, made Arion’s service more productive and also changed the needs for branches. Arion will continue to progress digitally, and in combination with a coherent digital and branch strategy, the Bank aims at being at the same level as FinAlta’s Digital Leaders.

Looking at the branch network of the Icelandic banks, i.e. not only of Arion, we see that there are still more branches per inhabitant than in the Nordics. This is due to the fact that habitation in Iceland is more spread out and the size of the country. Taking the (small) population into the equation along with Arion’s customer base, the following comparison is understandable.

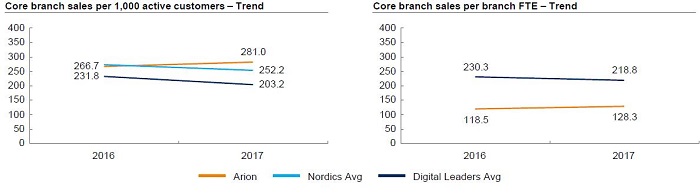

.jpg)

In terms of customer activity, Arion’s branches are more active in promoting and activating sales and services although it does it not as effectively per FTE (Full Time Employee) equivalent. Now, the question remains how to respond to the facts presented above, i.e. highly digitally active customer base that still views the branch network as an important factor to provide daily banking services.

The importance of a branch network

Despite digital advances in recent years, there are customers who regard personal service in the branches highly. These customers cannot and should not be neglected, but over time any bank will migrate such customers towards easier and more convenient self-service methods via desktop or mobile.

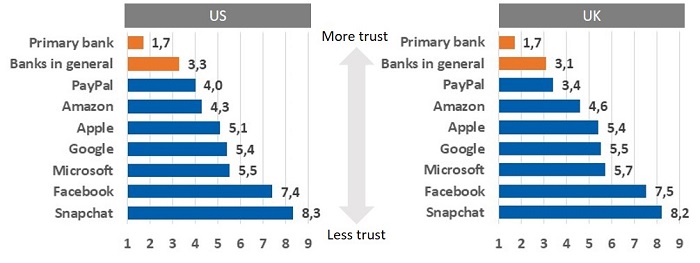

Branches also serve the purpose of being a window or entry level to a bank for consumers and therefore play an important part in marketing and image building. In its physical location and through design, a branch is also a reminder the bank exists. Physical locations build trust amongst consumers. A bank might have an excellent digital offering and promote good user experience. However, having a physical location and being visible in a city or village has the mere psychological effect on people that the bank is tangible and real. This is evident in people’s opinion on whom they mostly trust to safeguard their money. Banks are their first choice.

Customer ranking for trustworthiness, banks and technology firms. Source: Bain & Co. - Evolving the Customer Experience in Banking, 2017.

And branches have an important role in maintaining the trust. But every branch need not be like all others. They can and probably should have different purposes based on exact location, diversity of customer base and availability of services. A bank branch in an airport serves different needs to one in a village of 10,000 people or in the center of a large city.

What branch strategy to follow?

As much as a service company needs to adapt to ever-changing technological environment, the same company needs be aware of customer needs that constantly change. Banking in general, globally, will most likely undergo major changes in the next few years. Competition from FinTech or technology companies and new regulations put pressure on banks to adapt. The business model of banks is constantly under revision and all banks are focusing on leaner organizations and reviewing their cost structure in terms of technology and human capital. In parallel, the service level should at least be as good as or preferably better than before. Arion customers’ touchpoints with the bank are 96% digital.

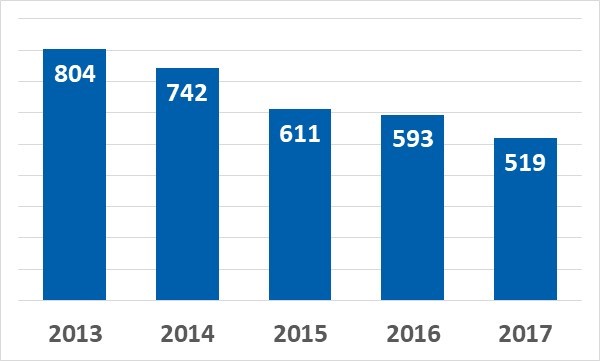

Customer visits to Arion's branches ('000s)

- Digital service initiated Dec´16

Arion has taken very effective measures in making its digital offering leaner and smoother, see further in White Paper: Arion Bank’s Digital Future Accelerator & The Leverage in Digital Banking Services. The key ingredient here is more convenient banking and the results have been very clear as the White Papers reveal. Customer needs have changed. Handling simple, yet important financial tasks like paying bills, transferring money, opening up new current and savings accounts, applying for a debit or credit card, spreading a credit card bill, getting temporary overdraft, are all available digitally and in self-service around the clock. This changes the nature of customers’ visits to branches where each visit on average is more meaningful, i.e. one visits the branch with more complicated issues that need more advice or problem solving.

In combination with its digital strategy, Arion has changed its branch strategy that better meets customers’ demands and needs.

Most or all banks around the globe have had to deal with different kinds of legacy, ranging from equipment, systems, culture and processes. Arion has methodically worked through all of the above. Based on this, Arion has chosen three different types of branches it will offer.

Arion's three types of branches in the network

Picture from “Your local branch” at in the greater Reykjavik area

Picture from “Your local branch” at in the greater Reykjavik area

Picture from “on the go” branch at Kringlan mall

Picture from “on the go” branch at Kringlan mall

Thirty years ago most or all branches were full service branches, which was both costly and required thorough employee training throughout the network. Over time and with better access to digital solutions, more modern ATMs and improved self-service equipment, remote customer sessions online and in the branches combined with other technology, the needs have changed. A parallel from the grocery market can be drawn with Arion’s branch approach.

All consumers are aware of and appreciate the diversity of grocery stores. Where they decide to shop depends on their needs in a particular time. Shopping for a fancy dinner party requires a visit to a different store than when only milk and bread are missing at home. The same applies for financial services. Consumers prefer and are used to staying local for simpler tasks while visiting centers of excellence for more complicated ones. This kind of divisional functionality is more convenient for customers and more cost effective for any company providing services.

More convenience and more efficiency serves customers and a bank better. Arion systematically works on educating customers base to help them adopt the available technological solutions at each time. Accessible service and embracing environment help customers engage with the bank. An example would be the branch in Kringlan mall in Reykjavik that looks more like an Apple store than a typical banking branch where there are no tellers or dividing spaces.

Convenient banking is here to stay

Arion Bank’s digital emphasis in recent years has truly impacted how customers interact with the bank. High digital adoption and increased service level has changed the needs in the bank’s branch network as a whole. Arion Bank has committed itself to being the digital banking leader in Iceland. Such venture does not happen in isolation and needs to reflect the service organization in full. Adjusting and modernizing the branch network is therefore an important factor in servicing the customer base. Splitting up the network based on service level was necessary to be able to meet new demands. Combined, Arion Bank’s digital and branch strategy, serves customers better than before in a more efficient manner. In essence, more convenient banking.

See more White Papers in the Further reading section below.

About Arion Bank

Arion Bank is a leading Icelandic bank offering universal financial services to companies, institutional investors and individuals. These services include corporate and retail banking, investment banking, capital markets services, treasury services, asset management and comprehensive wealth management for private banking clients.

Arion Bank’s balance sheet was more than 1,100 ISK billion (€8.9 billion) in 2017. Arion Bank only has operations in Iceland. Read more about Arion Bank.

Read more about Arion bank

About Iceland

Situated in the North Atlantic Ocean between Europe and the United States, Iceland is a European country with 330,000 inhabitants. The capital and largest city is Reykjavik. Two thirds of the country's population live in the Greater Reykjavik area. Iceland, as other Nordic countries, ranks high in economic, political and social stability and equality.

Icelandic citizens are early adopters when it comes to technology and technical infrastructure is good where 97% of residentials have access to internet. Iceland ranked number six globally in terms of GDP per capita in 2016 according to the International Monetary Fund.

About Iceland on iceland.is