Investing in Innovation

... and the creation of a Digital Future Accelerator

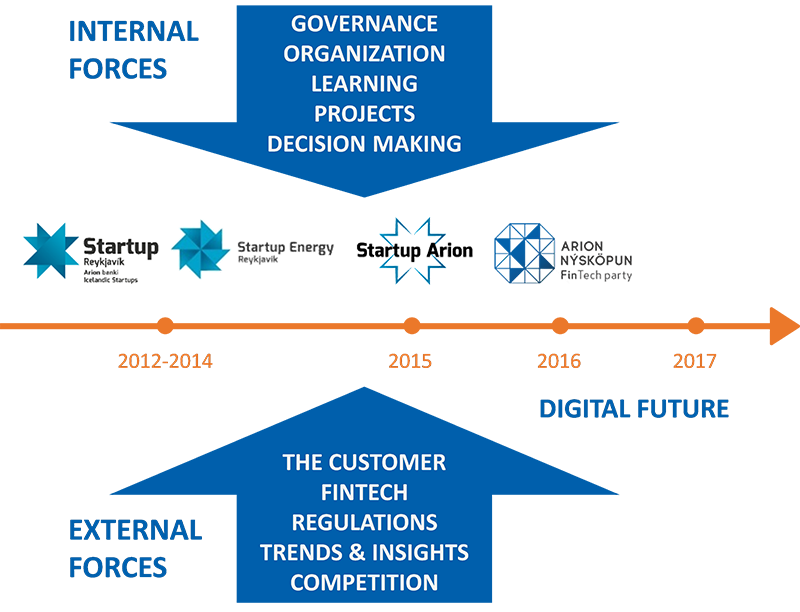

Since 2012 Arion Bank has invested in 80 startup companies in various industries through the startup programs Startup Reykjavik and Startup Energy Reykjavik. Experience from running these programs resulted in the Bank starting its own internal innovation program, Startup Arion. Today, the Bank operates a digital accelerator where digital products and customer journeys are re-engineered and delivered in a 16-week process. Furthermore, other IT projects that are not part of the accelerator are now worked on using the same agile methodology.

In 2008, the three large commercial banks in Iceland went bankrupt, the local currency plummeted, unemployment rose and the state finances were in ruins. The whole of Icelandic society was impacted.

Arion Bank, one of the three large commercial banks in Iceland, chose in 2012 to start invest heavily in the local startup ecosystem. Startup Reykjavik (SR), a seed stage, mentor driven startup program (business accelerator) was formed.

Annually, ten companies are chosen from an application pool and receive $22,000 in seed funding in exchange for 6% of the equity. The program runs for three months during which the teams sit in a joint facility and meet dozens of mentors from the Icelandic and non-Icelandic business community, ranging from C-suite, investors, entrepreneurs and academia. The goal is to speed up the process where each company becomes sustainable by aiding them in producing their first Minimum Viable Product (MVP), iterate and seek continuous feedback from customers. In short, this is the lean startup methodology in a nutshell. Since inception, over 80% of the participant companies focus on niched software or hardware solutions and the remainder on various verticals.

In 2014, Startup Energy Reykjavik (SER) was established. The same principles and methodology apply, yet this time only seven companies participate, and their business needs to have an energy or energy related focus.

In 2014, Startup Energy Reykjavik (SER) was established. The same principles and methodology apply, yet this time only seven companies participate, and their business needs to have an energy or energy related focus.

While SR and SER both had initially a clear business and social aspect to them, it gradually became obvious that how the startups developed, shaped and implemented their business and business models was also intriguing. The time from idea to execution was admirable. Could it be done in a larger organization like a bank?

Internal accelerator trial

In 2015, Ario n Bank decided to try out the lean startup methodology internally by initiating Startup Arion. Five teams were chosen from an application pool of 55 following an internal guerilla marketing campaign. Key ingredients were teams of 3-5 people from both business and IT, stationed at an offsite location while attending the accelerator. During the course of the project, the teams spent 12 full working days over the course of five weeks to develop their business ideas. Startup Arion ended with a live presentation for all employees, including top management. Presentations were broadcasted live throughout the Bank and made available immediately to everyone after the event on the Bank’s intranet.

n Bank decided to try out the lean startup methodology internally by initiating Startup Arion. Five teams were chosen from an application pool of 55 following an internal guerilla marketing campaign. Key ingredients were teams of 3-5 people from both business and IT, stationed at an offsite location while attending the accelerator. During the course of the project, the teams spent 12 full working days over the course of five weeks to develop their business ideas. Startup Arion ended with a live presentation for all employees, including top management. Presentations were broadcasted live throughout the Bank and made available immediately to everyone after the event on the Bank’s intranet. By mid-year 2017, two of the projects in Startup Arion had already been transformed into a product. The former is a streamlined digital customer onboarding process and the latter a sandbox banking API, see below.

FinTech on the rise

The rise of FinTech startups, as well as discussion and investment in the banking industry globally, underlined the need for new methods of innovation and implementation. Forthcoming yet somewhat distant EU regulations, e.g. PSD2, MiFiD 2 and GDPR only accelerated the internal discussion. How would the current banking model be affected? How should the Bank tackle the agile and fast moving FinTech startups? There was one way to find out. Arion Bank’s FinTech Party (hackathon) was launched in spring of 2016.

FinTech Party was a 30-hour hackathon where 11 teams hacked away in the Bank’s headquarters.

The FinTech Party needed to answer three propositions:

- Could Arion Bank’s IT division finalize an API sandbox in 10 weeks?

- Would any teams participate in the hackathon?

- Could the teams build something and technically connect and communicate with the Bank?

All three propositions were strongly confirmed.

„Startup Arion proved three things for us. Small, diverse teams could accomplish complicated tasks. The speed of delivery was much higher and feedback from customers was immediately implemented in the products“ - Einar Gunnar Gudmundsson, CEO's Office.

From one speed to two speed IT and back to one speed… now in second gear

The years 2016 and 2017 turned out to be years of structural changes in IT at Arion Bank. A strong need had been created internally to faster adapt and seamlessly push new digital products to the market. Better (digital) customer engagement with end-to-end processes being redesigned from scratch was the target. The Arion Digital Future accelerator, see in Further reading, was put in place.The key principles in Digital Future are that a single customer journey is completely re-engineered during the course of sixteen weeks where a team of 10-15 employees of the Bank from different divisions are co-located to deliver a finalized digital product.

Arion Digital Future has already proved to be highly effective and pushed the Bank further into investing in digital customer engagement. Any corporate activity, project or decision is not undertaken or made in isolation. Arion Bank’s commitment to the digital journey does not have its roots in a single C-suite decision to “become digital” but is a result of both internal and external factors that have influenced the decision making process. With the establishment of Arion Digital Future Accelerator, re-engineering customer journeys has become part of the Bank’s cultural genome.

The experience of Arion Digital Future, of working with a speedier process to deliver digital products, turned out to be so positive that the format was applied to other operational IT projects by the Bank. In a nutshell, Arion Bank therefore had transformed its IT from a traditional one-speed, to two-speed and back to one-speed, but in an entirely different gear.

Customer journey is king

The first process the Digital Accelerator redesigned was retail customer onboarding. [See White Paper: Redesigning Customer Onboarding] where the process of becoming a customer of the Bank was shortened to three minutes. The customer has in that timeframe finished Anti Money Laundering, digitally signed a contract for establishing a current account with a debit card and access to his or her internet bank. Within three days, the customer receives the debit card in the mail.„The ambition is a 10X impact rather than a marginal 10-20% improvement in any given Digital Future project“ - Höskuldur H. Ólafsson - CEO Arion BankOther processes include Corporate Customer Onboarding, opening new accounts, new credit cards, spreading credit card payment, credit assessment for mortgages, mobile cash transfers, mortgage lending, online trading, pension fund services, start / change personal overdraft, change credit card limit and freeze / reopen credit cards. All solutions are fully automated end-to-end customer journeys where the customer can self-service himself anywhere and anytime.

Intentional investment in innovation

Business and product development needs time and capital to flourish. Since 2012, Arion Bank has consistently invested in Icelandic startup companies, carefully rethought its approach to internal innovation and re-organized its corporate structure accordingly. It is a result of the Bank’s top management strong commitment, financially and behaviorally, to corporate development and the Bank’s adaptation capabilities. All in all, this commitment affects the whole organization. A clear message from management encourages a bottom-up approach of the Bank’s employees towards innovation in a wide perspective.About Arion Bank

Arion Bank is a leading Icelandic bank offering universal financial services to companies, institutional investors and individuals. These services include corporate and retail banking, investment banking, capital markets services, treasury services, asset management and comprehensive wealth management for private banking clients.

Arion Bank’s balance sheet was more than 1,100 ISK billion (€8.9 billion) in 2017. Arion Bank only has operations in Iceland. Read more about Arion Bank.

Read more about Arion bank

About Iceland

Situated in the North Atlantic Ocean between Europe and the United States, Iceland is a European country with 330,000 inhabitants. The capital and largest city is Reykjavik. Two thirds of the country's population live in the Greater Reykjavik area. Iceland, as other Nordic countries, ranks high in economic, political and social stability and equality.

Icelandic citizens are early adopters when it comes to technology and technical infrastructure is good where 97% of residentials have access to internet. Iceland ranked number six globally in terms of GDP per capita in 2016 according to the International Monetary Fund.

About Iceland on iceland.is