Redesigning Customer Onboarding

Retail & Corporate Banking

Customer onboarding and Know Your Client (KYC) processes are key prerequisites for a relationship between a financial institutions and their customers. For customers, retail or corporate, the onboarding process has historically been a tedious one. Gathering financial documentation, answering questionnaires and Anti Money Laundering (AML) forms may seem non-value adding for them. Redesigning this process would therefore be of value to both the customer and the bank, particularly if the bank could minimize the time spent on the process and remove paper altogether at the same time. Arion Bank’s onboarding process for retail customers now takes three minutes and is fully digitized. The project was the first one to go through Arion Bank’s Digital Future Accelerator, where end-to-end customer journeys are re-engineered and digitized.

In 2016, Arion Bank established its Digital Future Accelerator as a means to deliver digitals products to its customer base and respond to competition from banks and FinTech companies. In essence, the accelerator is a 16 weeks project, where employees with the relevant expertise are co-located and their responsibility is to re-engineer a single customer journey. The team of 10-15 people are committed to this single project only during the 16 weeks and return to their daily jobs afterwards. [See in Further reading: Arion Bank Digital Future Accelerator]. The first project Digital Future committed to was Customer Onboarding of retail customers.

Customer Onboarding is usually complicated for banking customers

Becoming a client of a bank is to many people a burden. The process is mandatory yet tedious to most people. For corporates the process was even more formal and lengthy. Or so it used to be.Total redesign of a customer journey

Redesigning a process requires solution finding rather than problem solving. One of the key principles of Digital Future is Customer Focus. How could a customer journey be structured in such a way that the whole process would be seamless and at the same time gather all necessary documentation, meet regulatory requirements and fulfill formalities in terms of security, document traceability and data gathering. The national Icelandic Electronic Identification system (eID) was pivotal in shaping the process. With eIDs, a two factor authentication system easily available to all those with an Icelandic social security number, the identification and security process was much more feasible to develop. The service is an API and a widely used one, particularly by government institutions, e.g. Tax Office and Social Insurance amongst others. [See Callout box on eIDs in White paper Arion Bank Digital Future Accelerator]. Despite being based on a different technology, the Icelandic eID system has the same functionality as the Swedish Bank ID. Around 2/3 of the Icelandic population over the age of 18 already has an eID. Arion Bank’s new Onboarding process requires customers to have the Icelandic eID on their mobile phones. Customers not with an eID are required to visit a branch to complete the onboarding process.Onboarding of retail customers

Onboarding a customer is a prerequisite for doing business. Regulatory demands require financial institutions to be strict on what information clients provide (KYC) and the AML process focuses on the origin of capital the clients to hinder money laundering. Receiving the documents via email / downloading them from a website / sitting down with the bank’s representative, filling out the various forms and questionnaires, showing an ID, returning to the bank and deliver the signed documents error free, is at least a 40 minutes process, often up to a few days. These used to be the expectations of Icelandic consumers. Arion Bank has now reduced the retail customer onboarding to three minutes

„The onboarding process went from 45 minutes in full personal service on average to 3 minutes in self service.“ Iða Benediktsdottir – MD of Retail Banking

What the redesign process entailed

Re-engineering a customer journey in its plainest form is to entirely toss away processes how things have been done and redesign it from scratch from the customer’s perspective. For Arion Bank specifically, this meant:

- User interface in app and internet bank

- Rewriting of Terms and conditions where two contracts of total 20 pages was reduced to one contract of 2 ½ pages AML questionnaire redesign

- Electronic signature Documentation and CRM integration

- User interface for the Bank’s employees

- Development of a new risk assessment procedure to sell lending products to completely new customers

- Deep integration between various systems making sure that the customer is fully established in all of the Bank’s systems

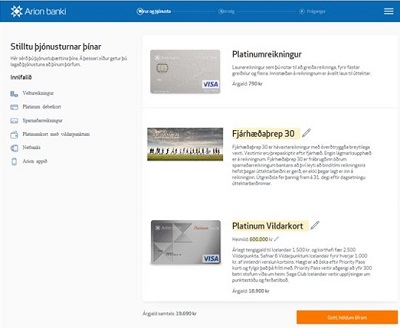

Onboarding is a prerequisite for service offerings

Upon becoming a client through the onboarding, the customer will have established a current account with a debit card. In the process, the customer is given the choice of establishing a savings account and applying for a credit card. These offerings in addition to all other of the Bank’s offerings are evidently available at any time, whether digitally or in the Bank’s branch network.

Time savings and efficiency

The onboarding process is an immense time saving factor and more convenient for customers. Offering an end-to-end digital process also strongly signals to customers the path the Bank is on and shifts customers’ expectations on future communications with the Bank. Some of these expectations may be transferred to other banks in Iceland. For Arion Bank, the onboarding process has given more room for engaging conversations with the Bank’s customers instead of a more functional discussion on how to become a client and filling out forms on paper.

.jpg)

Customer first chooses his product line...

then individual products…

...before signing the contract… …

...electronically with eID via mobile phone / tablet.

Onboarding of corporate customers

Anyone that has established a bank account for a company understands the dire need to make the process swifter. The need stems not only from the sheer amount of paperwork needed, but signed declarations from accountants, copies of valid IDs and signatures on most or all documents from the majority of the Board of Directors (BoD), etc. Time needed for collection of all required information and signatures from the BoD is usually extremely time consuming. See also welcome screen on Arion Bank’s website. Given the fact that both executives with power of procuration and members of the BoD have eIDs, the onboarding process of a corporate customer now takes less than 15 minutes. Looking back at the traditional corporate customer onboarding, those responsible for starting a relationship with a bank, whether internal (usually CEO) or external parties like legal advisors or accounting firms, the new process is a huge benefit for everyone concerned.

"Redesigning a process requires solution finding rather than problem solving" - Rakel Ottarsdottir, CTO

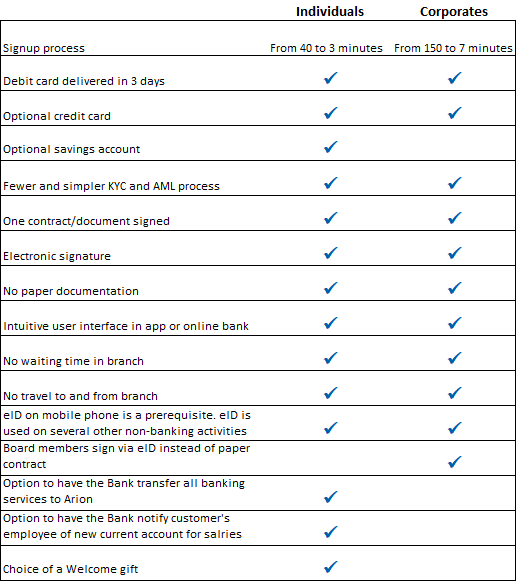

Retail and Corporate customer benefits

For any given retail customer, the average amount of time saved is 35 minutes and for a corporate customer 150 minutes with zero error risk in documentation. For customers, key benefits include:

Notably, the signup process for corporate is more time consuming, especially gathering all the right signatures from all required individuals. Although most of this work is often performed by parties other than the companies themselves, e.g. accountants or advisors, removing this lengthy and manual process is a huge benefit.

Increased efficiency for the Bank

Before the new onboarding process was implemented, the work needed by the Bank’s employees by filing all documentation, retyping relevant information in different IT systems with all the error risk associated with such manual labor, was substantial. That is no longer the case. Once on-boarded through the current process, both individuals and corporates are fully registered and established customers of Arion Bank without intervention or engagement on behalf of the Bank’s employees.

Average time savings per individual customer are 70 minutes and 4 hours per corporate customers with zero error risk in documentation. In essence: Leaner and smoother banking.

Increased efficiency for the Bank

Before the new onboarding process was implemented, the work needed by the Bank’s employees by filing all documentation, retyping relevant information in different IT systems with all the error risk associated with such manual labor, was substantial. That is no longer the case. Once on-boarded through the current process, both individuals and corporates are fully registered and established customers of Arion Bank without intervention or engagement on behalf of the Bank’s employees.

Average time savings per individual customer are 70 minutes and 4 hours per corporate customers with zero error risk in documentation. In essence: Leaner and smoother banking.

What our customers say

Given the chance to adjust one‘s credit card limit, customers responded instantly with high usage. In the first three months after introducing the service, the number of changes in credit card limits increased 140% compared to the monthly average of the two previous years. Such noticeable change in customer behavior is a decent confirmation of convenient banking.

About Iceland on iceland.is

About Iceland

Situated in the North Atlantic Ocean between Europe and the United States, Iceland is a European country with 330,000 inhabitants. The capital and largest city is Reykjavik. Two thirds of the country's population live in the Greater Reykjavik area. Iceland, as other Nordic countries, ranks high in economic, political and social stability and equality.

Icelandic citizens are early adopters when it comes to technology and technical infrastructure is good where 97% of residentials have access to internet. Iceland ranked number six globally in terms of GDP per capita in 2016 according to the International Monetary Fund.

About Iceland on iceland.is